Review: Dave Ramsey’s Foundations in Personal Finance Homeschool Edition

This past summer, while I was still trying to overcome last year’s homeschool mom burnout, I got an email about reviewing a new product for homeschoolers from Dave Ramsey, Foundations in Personal Finance: Homeschool Edition. I let the email sit in my inbox for a week or two because, while it sounded like something that would benefit Brianna, I didn’t want anything else on my plate. I didn’t want anything else that I would have to teach.

After almost deleting the email, I did a little research. What I found indicated that the 4-disc DVD set could be watched independently by the student. The short, workbook lessons were designed to be completed by the student while watching the short 15-minute DVD segments.

It wouldn’t require a lot of extra work from me. Sounds good.

I’ve reviewed a lot of products here on WUHS and I always try to post honest, thoughtful, balanced reviews because it all boils down to a matter of taste – what we loved may not work for your family; what we didn’t care for may be just what you’re looking for. For that reason, I try to avoid making sweeping, generalized statements that would apply to all homeschooling families.

So, this is a first for me.

I don’t think any American high school student should graduate without completing this course.

It’s incredible! I had planned to watch a few segments – not the entire course – with Brianna so that I could evaluate the program for review. Now, I won’t let her watch them without me. I’m learning as much as she is and only wishing I’d learned it at her age!

The videos are recorded sessions of Dave Ramsey teaching at what appears to be a college. The audience is mostly students, but there are a lot of parents in attendance, as well. Dave is engaging, funny, and just plain entertaining as he takes often complex concepts and makes them easily understandable.

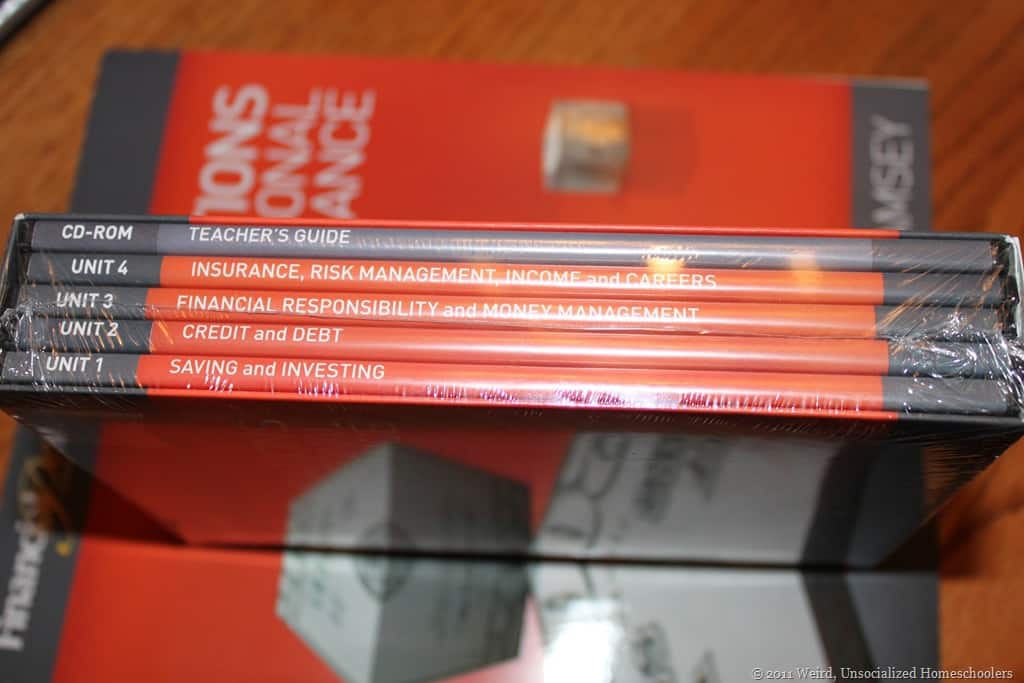

If you’ve ever gone through Dave Ramsey’s Financial Peace course (I haven’t), you’ll probably find a lot of the same concepts, such as the 7 Baby Steps to financial peace. The course covers:

- Saving and Investing

- Credit and Debt

- Financial Responsibility and Money Management

- Insurance/Risk Management and Income/Careers

Each DVD segment is only about 15 minutes long and the workbook is used in conjunction with the videos, offering fill-in-the-blank note-taking, along with extra tidbits of information in the sidebars.

It’s not unusual for us to go through two or three sessions at a time simply because we’re enjoying watching them.

Also included in the workbook are “before and after” questions to answer, well, before and after watching each unit. These sections are basically for gaining an understanding of what you know – or what you think you know – then, reinforcing what you’ve learned after the unit.

There is also a review section at the end of each chapter which includes vocabulary (there’s a glossary in the back of the workbook), matching, multiple-choice, and short answer questions to test the student’s knowledge on what he or she has learned.

In addition to the DVDs, there is also a teacher’s guide on CD-ROM, which includes:

- A Getting Started guide

- Pre- and post-tests

- Three assessments for each chapter

- Unit tests, final exam and answers keys

- Additional forms that you might want to use during the course

- Lesson plans for either a 45- or 90-day syllabus

Foundations in Personal Finance makes an excellent high-school economics course. Because this curriculum is designed for high school students, Dave offers his unique perspective on the savings and spending choices they’ll face. For example, the amount he suggests having as an emergency fund is different for students than for adults. He also doesn’t encourage investing for kids until they’ve saved for other big expenses in their lives, such as college.

The course is available from Dave Ramsey’s website for $99, which includes the 4-disc DVD set, the teacher’s guide on CD, and one student workbooks. Additional student books can be purchased for $12.49.

This course has already changed Brianna’s and my outlook on saving and spending. I’ve been trying to get my husband to sit down and watch it with us, but you know how it can be finding time for that. We may just take a weekend soon and watch the whole thing because I really want him to see it, too.

I can only imagine the difference this kind of course might have made in the early years of our marriage and even our current outlook on saving and spending. I want my kids to avoid some of the financial mistakes that we made. That’s why each of them will be required to watch this course before they graduate from our homeschool.

I don’t think it will take much arm-twisting, though, because it’s as entertaining as it is educational.

Kris Bales is a newly-retired homeschool mom and the quirky, Christ-following, painfully honest founder (and former owner) of Weird, Unsocialized Homeschoolers. She has a pretty serious addiction to sweet tea and Words with Friends. Kris and her husband of over 30 years are parents to three amazing homeschool grads. They share their home with three dogs, two cats, a ball python, a bearded dragon, and seven birds.

Bummer – I was hoping that this was going to have a give-away attached. Oh well, I'm still glad to know that this course is great. I loved FPU – so, I'm sure this was just as awesome. Going to have to remember to order this soon!

Thanks for posting this. My kids are 9 and 10 so we're a few years from needing it, but I love Dave Ramsey (really need to take his Financial Peace course for myself!) so I'm going to bookmark this for future reference.

I took his financial peace class several years ago, almost 4 years ago to be exact. The class was amazing. Thanks to him we are debt free with the exception of our house note and we did it all one salary. I highly recommend his course to everyone I meet. I am going to purchase his financial peace jr for my boys who are not high school age.

I am very excited just reading this!! My children are only 6 and 3 but this will be a must for us as well!! My husband and I did FPU through our church a few years ago and while a lot of our money habits have been adjusted we will have a lot of work. After you're grown it can be hard to get rid of some habits. :-/ Anyway, I know if we did this when we were in high school or even as part of premarital counseling we would have avoided so many mistakes! Thanks for your review!

Wonderful! What grade do you think you could start this? Sixth may be too young, huh? I completely agree that all kids should understand personal finance.

There’s a middle school version too!

Yeah, sixth grade might be too young. Most of the kids in the discussion parts of the videos were probably 16-18. Hope that helps!

I've heard really good things about this. Thanks for the review!

Kris,

Thank you for this review. I had planned on my children completing a personal finances course during high school but wasn't sure what curriculum to use. With your glowing review, you just made that a lot easier! Two questions, though – does he explain about mortgages in this course? Also, is a recommendation given for awarding high school credit in the teacher's guide? I'm thinking it sounds like a 1/2 credit course. Thanks again for the great review!

Samantha

Its a wonderful study! My oldest is going through it right now! I sit and watch the DVDs also…mostly because I like Dave Ramsey! 😉

Mortgages are covered in Chapter 12. We haven't gotten that far yet, so I'm not sure how indepth it goes. It's supposed to be enough material for one semester, so that would be a 1/2 credit course, I believe. Hope that helps!

Is this review of the 2008 version?

I’m not sure which version it was. The review was written in 2011, if that helps.

Dave Ramsey has made a huge difference in our lives. His book helped our marriage, brought down our stress level, and of course, is helping us get out of debt. I highly recommend it to people and that is why I'm not at all surprised at your bold statement! What age would you recommend kids be before they start the homeschool edition program?

Thank you so much for telling your readers about this! It is just what we have been looking for this week! I really appreciate all of the work you do and the wisdom you share through this blog.

I'd say high school age. Most of the kids in the DVD were 16 or so and up — kids starting to work and save for college.

Thanks, Jacqueline!

This sounds like a great course! We took FPU and it was awesome. We are now debt free, except for the house. My daughter is only 7, but I look forward to her using this program!

I am so glad to find your review of this curriculum. I want to buy it, but am having trouble finding a used version for much less moolah. Do you know anyone willing to sell or loan out theirs? I am also looking for an American Government course that doesn’t leave things out ( seems a lot of Christian ones do…sad to say) and tell the facts (not just trying to put a left spin on everything). Also, Economics course. Have your children had these courses yet? If so, would you recommend any curriculum for these? Thank you! Wish I had seen this website before!!!! LOL! Love the title

We use Whatever Happened to Penny Candy and the accompanying guide for economics. We’re planning to use other “Uncle Eric” books and their guides for government/economics/civics.

I was wondering if this would be appropriate to use as a group study at church for adults in place of the adult version. It sounds like it may be more educational and easier to understand. Also it would be more affordable. What are your thoughts ?

I’ve never seen the adult version, so I really can’t say how the two compare.

Thank you for this post. We’re pulling out of public and virtual school for our 9th grader. Starting next school year, we will pull out our other two as well (will be 9th and 7th then). I would not have known about or found this financial course without this blog. Thank you! Much needed information, thank you for taking the time to write about it!

Hi, I work at a co-op and we have thought about offering this course as a summer camp for our high schoolers. In your opinion, do you think it could be completed in 3 weeks (mon-fri, 3 hrs a day)?

Thanks!

There are 4 units with 3 chapters each. I think that would be a lot to cover in just 3 weeks.

I am considering teaching a personal finance class in a co-op setting, 1 day a week for 9 weeks. Do you think I can make something work by selecting 1 15 minute video to watch in class and then answering questions and doing a group project in each class (class time is 1.5 hours)? Are there project suggestions in the book? I know we won’t cover the entire book. I’d have the kids purchase the student book though.

There are 4 units with a total of 12 chapters. I think that might be a lot of material to cover in 9 weeks, but it may be doable. Dave Ramsey is a very engaging speaker, so he holding your students’ interest probably wouldn’t be an issue. I don’t remember if there are project suggestions on the teacher disc or not. Hope that helps!

I am going to use this next year in our homeschool with my 3 high school kids. Do you think each kids needs their own workbook?

Yes, they will each need their own workbooks.

You state in your blog about Dave Ramsey Course for Homeschoolers that the complete set is 99.00 and you can purchase additional books for $12.49 do you know if this was a 1-time offer or if there is a coupon code for this pricing? Do you know if they offer homeschool group discounts or Military discounts?

Thank you

That was the price when the review was published, but that’s been nearly 6 years. I’m not sure what the current price is and I’m not sure if they offer military discounts. I would suggest contacting them as many companies do offer such discounts – https://www.daveramsey.com/company/contact-us/?snid=footer.company.contact.

This post was made 7 years ago, I am curious if this program still has an impact on your daughter and yourself? I am looking to buy it for my 11th grader. After 7 years since this post, do you believe the price of this personal finance course is still worth it?

Yes, I’ve used it with both of my older kids and my youngest will be taking the course this year.

I have a 7th grader and a 9th grader. Would the high school level be okay to use for both? Have you used the middle school version? Thanks for your input!

I didn’t even know there was a middle school version. I have the original and I went ahead and got workbooks for all three kids at the time, so that’s what I’ve used with all of them. Sorry!